Introduction: A Landmark Strategic Partnership

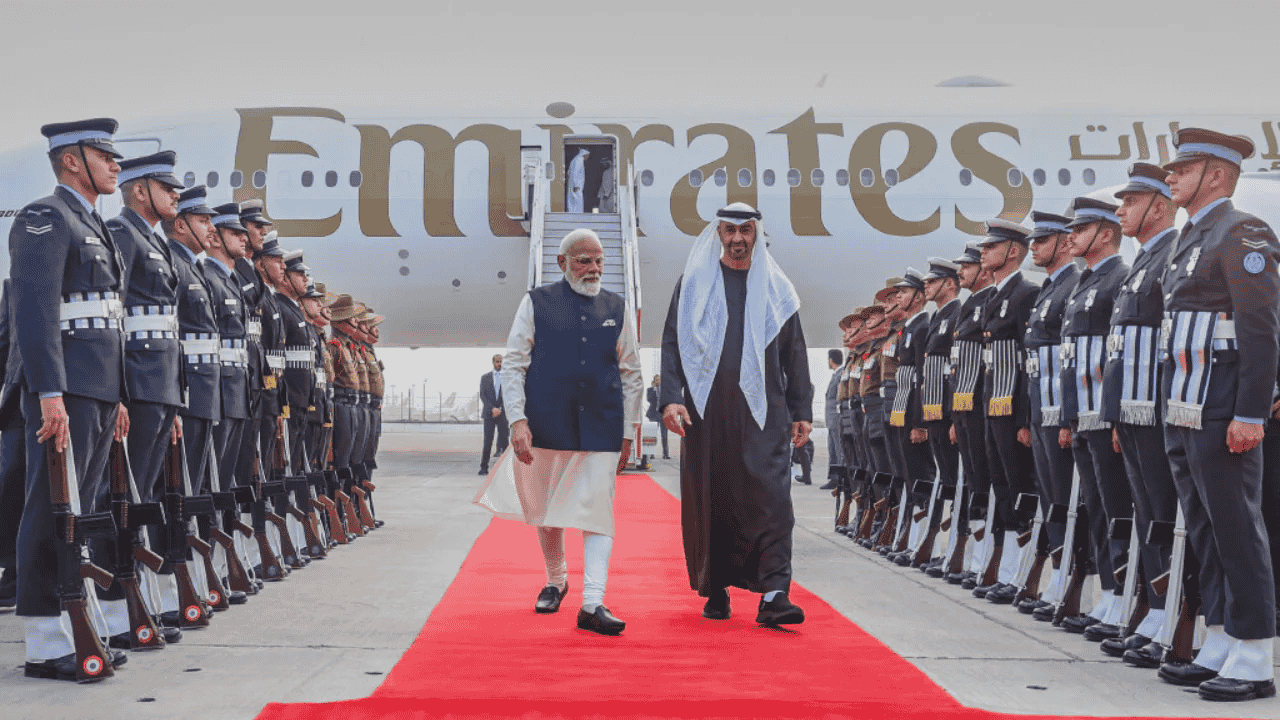

India and the United Arab Emirates reached a historic milestone on January 19, 2026, when UAE President Sheikh Mohamed bin Zayed Al Nahyan paid a focused three-hour official visit to New Delhi. During this highly substantive bilateral engagement with Prime Minister Narendra Modi, the two nations unveiled twelve transformative agreements spanning trade, energy, technology, defence, and space cooperation. The centerpiece of this diplomatic milestone is an ambitious plan to double bilateral trade from the current $100 billion to $200 billion by 2032—reflecting the deepening strategic partnership between India and one of its most crucial allies in West Asia.

The visit itself carried symbolic significance. PM Modi personally received the UAE President at Delhi Airport—a rare diplomatic gesture that underscored the exceptional warmth between the two leaders. This was Sheikh Mohamed's fifth visit to India in a decade and his third official visit as UAE President, highlighting the frequency and intensity of high-level engagement between New Delhi and Abu Dhabi.

The $200 Billion Trade Ambition: Building on CEPA Success

From $100 Billion to $200 Billion: A Realistic Trajectory

The decision to double bilateral trade to $200 billion by 2032 represents a bold but achievable target rooted in demonstrated economic momentum. Current bilateral trade stands at $100 billion in FY 2024-25, a milestone reached just three years after the Comprehensive Economic Partnership Agreement (CEPA) came into force on May 1, 2022.

The CEPA itself was transformational. Signed in February 2022, it marked India's first comprehensive free trade agreement in over a decade and provided preferential market access to over 97% of UAE's tariff lines, accounting for 99% of Indian exports. Unlike traditional trade pacts, CEPA introduced novel provisions including a dedicated digital trade chapter—reflecting both nations' commitment to 21st-century commerce.

MSME Empowerment: The Core Strategy

Rather than relying solely on large corporate exports, both nations recognize that scaling trade requires grassroots entrepreneurship. The trade expansion strategy hinges on three flagship initiatives:

| Initiative | Purpose | Target Markets |

|---|---|---|

| Bharat Mart | 2.7 million sq. ft. B2B/B2C marketplace in Dubai's Jebel Ali Free Zone; 1,500+ showrooms; 700,000+ sq. ft. warehousing | Middle East, Africa, Eurasia |

| Virtual Trade Corridor | Digital + physical infrastructure enabling MSME-to-MSME connections and seamless cross-border transactions | Bilateral and regional |

| Bharat-Africa Setu | Dedicated platform promoting Indian MSME products to African markets via UAE logistics hub | Africa and beyond |

Bharat Mart, under construction by DP World, is particularly significant. Located just 11 km from Jebel Ali Port, 15 km from Al Maktoum International Airport, and with direct Etihad Rail access, it will connect Indian exporters to 150 maritime destinations and over 300 global cities. Phase 1 is targeted for completion by end of 2026, with the facility designed to support women-led businesses and light manufacturing units.

The MSME focus addresses a structural bottleneck in India's economy: while MSMEs contribute over 30% to GDP and employ 110+ million people, accessing international markets remains challenging for small businesses.

Energy Security: The LNG Supply Agreement

A Decade-Long Energy Partnership

In a significant move to strengthen India's energy security, Hindustan Petroleum Corporation Limited (HPCL) and UAE's ADNOC Gas signed a 10-year liquefied natural gas (LNG) supply agreement during the visit. Under this deal, HPCL will purchase 0.5 million metric tonnes per annum (MMTPA) of LNG from ADNOC Gas' Das Island facility, with supplies beginning in 2028.

While 0.5 MMTPA may seem modest, it represents a strategic piece in India's broader energy transition puzzle. India aims to increase the share of natural gas in its primary energy mix from the current 6–7% to 15% by 2030—a critical component of the country's decarbonization strategy. This LNG deal is the third long-term agreement ADNOC Gas has signed with Indian energy majors in the past year, alongside commitments with Indian Oil Corporation (1 MMTPA for 15 years) and GAIL India (0.52 MMTPA for 10 years).

Why Natural Gas Matters for India's Energy Transition

LNG is increasingly central to India's net-zero ambitions:

Lower Carbon Emissions: Natural gas produces 50–60% fewer emissions than coal for the same energy output, making it a crucial transitional fuel during the shift to renewables.

Industrial Support: Gas is essential for energy-intensive industries like fertilizers, chemicals, and steel, where switching to renewables remains technologically challenging.

Power Generation Flexibility: Unlike renewables, gas plants provide reliable, dispatchable power to balance grid stability as India expands solar and wind capacity.

Infrastructure Growth: India is expanding gas pipeline networks from 25,429 km to 33,475 km by 2030, while LNG import terminal capacity grows from 52.7 MMTPA to 66.7 MMTPA.

The UAE is now India's second-largest LNG supplier after Australia, a strategic hedge against energy supply disruptions in an increasingly volatile geopolitical landscape.

Digital Embassies: Pioneering Data Sovereignty

A Novel Concept with Global Implications

Perhaps the most innovative outcome of the bilateral meeting is the agreement to explore establishing "Digital Embassies" between India and the UAE—a concept Foreign Secretary Vikram Misri described as "an interesting new frontier" in international cooperation.

A Digital Embassy (or Data Embassy) represents a groundbreaking approach to data sovereignty. It involves extending a country's secure cloud infrastructure through state-owned servers located outside its physical borders, typically within the territory of an allied nation. These embassies provide protection against cyber attacks and physical threats while maintaining immunity from the host country's local laws, all under mutually recognized sovereignty frameworks.

Why This Matters: Strategic Context

Only a handful of countries worldwide have successfully implemented digital embassies—making India and the UAE's decision to explore this model highly significant. In an era of increasing geopolitical tensions and sophisticated cyber threats, data embassies address a critical vulnerability: the concentration of a nation's strategically important data within its own borders.

Key considerations for UPSC aspirants:

Data Sovereignty vs. Cloud Accessibility: While cloud technology offers scalability and reliability, nations must balance efficiency with ensuring sensitive data remains under sovereign control.

Geopolitical Strategy: Digital embassies reflect the broader "strategic autonomy" both India and UAE emphasize in their foreign policy, particularly amid great-power competition.

Legal Precedent: Both nations will need to develop regulatory frameworks addressing cross-border data governance, liability, dispute resolution, and compliance with international agreements.

Cybersecurity Architecture: The framework must address how embassies defend against state-sponsored cyber attacks, ransomware, and data breaches.

Supercomputing Cluster: India's AI Infrastructure Leap

A Transformative Technology Investment

UAE-based AI conglomerate G42 will partner with India's C-DAC (Centre for Development of Advanced Computing) to establish a supercomputing cluster in India, representing a quantum leap in the country's computational capacity.

The scale is remarkable: G42 will deploy up to 2 gigawatts (GW) of AI-ready data centre infrastructure with a supercomputer delivering up to 8 exaFLOPS performance (built in partnership with Cerebras Systems). To contextualize this achievement, the new capacity would nearly double India's total existing data centre capacity, which currently stands at 1–1.5 GW.

Strategic Implications for India's AI Future

This investment directly supports India's aspirations in three areas:

Research & Development: India's research institutions, from IITs to national laboratories, will gain access to world-class computational resources for cutting-edge research in climate modeling, biotechnology, materials science, and drug discovery.

AI Model Development: With the UAE also supporting NANDA, a 13-billion parameter Hindi-centric large language model, India is building indigenous AI capabilities across linguistic and cultural contexts—reducing dependence on foreign AI platforms.

Data Processing Infrastructure: Critical government applications, from census analysis to agricultural forecasting, will benefit from in-country compute capacity, addressing both performance and data sovereignty concerns.

The supercomputing cluster announcement aligns with the February 2026 AI Impact Summit to be hosted in India, with high-level UAE participation expected.

Advanced Nuclear Technology: A Shared Path to Clean Energy

The SHANTI Act Enables New Cooperation

The two nations agreed to explore partnership in advanced nuclear technologies, including large nuclear reactors and Small Modular Reactors (SMRs), as well as cooperation in advanced reactor systems, nuclear power plant operations, maintenance, and nuclear safety.

This cooperation becomes possible following India's historic passage of the Sustainable Harnessing and Advancement of Nuclear Energy for Transforming India (SHANTI) Act, 2025, which received presidential assent on December 20, 2025.

The SHANTI Act: A Watershed Moment

For the first time since independence, the SHANTI Act permits private Indian companies and foreign entities to build, own, operate, and decommission nuclear power plants—ending the government monopoly held by the Nuclear Power Corporation of India (NPCIL).

| Key Feature | Significance |

|---|---|

| Private Participation | Unlocks private capital and expertise in nuclear energy sector |

| Strategic Safeguards | Government retains control over nuclear fuel production, waste management, and enrichment |

| Regulatory Independence | Atomic Energy Regulatory Board (AERB) gains statutory status, strengthening safety oversight |

| Liability Framework | Operators bear liability linked to plant capacity (INR 100 crore to INR 3,000 crore), capped at 300 million SDRs globally |

| Advanced Reactor Support | Enables deployment of SMRs and indigenous reactor designs for clean energy transition |

India's SMR Ambitions

India is developing three types of SMRs:

200 MWe Bharat Small Modular Reactor (BSMR-200): Pressurized water reactor technology using slightly enriched uranium; lead units planned for Maharashtra and Andhra Pradesh.

55 MWe SMR: Flexible capacity option for diverse grid configurations and industrial applications.

5 MWt High-Temperature Gas-Cooled Reactor: Designed for hydrogen production, supporting transport sector decarbonization.

India has set an ambitious target of achieving 100 GWe of nuclear power capacity by 2047, with SMRs playing a crucial role alongside large reactors. The government allocated 200 billion Indian rupees ($2.2 billion) for a nuclear energy mission to develop at least five indigenously designed and operational SMRs by 2033.

Why SMRs Matter for India:

Grid Decentralization: Can provide power to smaller, less-developed grids without massive infrastructure overhauls.

Industrial Heat: High-temperature designs support industrial decarbonization in sectors like steel and chemicals.

Capital Efficiency: Lower upfront costs and construction timelines compared to conventional 1,000+ MW reactors.

Security Applications: Reduced nuclear material requirements lower non-proliferation risks.

Strategic Investment in Dholera: Building Infrastructure for the Future

A Mega Special Investment Region

The two governments signed a Letter of Intent for UAE investment in Gujarat's Dholera Special Investment Region (DSIR), envisioning strategic infrastructure development including:

An international airport

A pilot training school

A maintenance, repair, and overhaul (MRO) facility

A greenfield port

A smart urban township

Railway connectivity and energy infrastructure

Spanning approximately 920 square kilometers, DSIR is one of India's most ambitious infrastructure initiatives along the Delhi-Mumbai Industrial Corridor. The projected capacity is extraordinary: by 2050, the region could support a population of 2 million and provide employment for approximately 800,000 people.

The UAE investment transforms DSIR from a primarily domestic initiative into a potential regional logistics and manufacturing hub, with UAE's strategic location enabling connectivity to Middle Eastern, African, and Southeast Asian markets.

Financial Connectivity: GIFT City as a Regional Hub

GIFT City: Dubai's Competition

Two major UAE financial and logistics firms will establish operations in Gujarat's Global Financial and Investment Centre (GIFT City):

First Abu Dhabi Bank (FAB): Establishing a full branch to facilitate trade and investment linkages between Indian corporates and GCC/MENA markets.

DP World: Operating comprehensive logistics and shipping services, including vessel leasing for global operations.

These moves position GIFT City as a credible alternative to traditional Middle Eastern financial hubs, particularly for Indian exporters seeking integration into global supply chains. FAB's presence bridges Indian businesses directly to Gulf Cooperation Council (GCC) networks.

Strategic Defence & Space Cooperation

Deepening Military Ties

Both nations signed a Letter of Intent toward concluding a comprehensive Strategic Defence Partnership, with the statement noting "steady and strong bilateral defence and security cooperation as a core pillar" of the Comprehensive Strategic Partnership.

Recent defence engagement includes:

Exchange of visits by Service Chiefs and Commanders across the Indian and UAE armed forces (Army, Navy, Air Force)

Successful conduct of bilateral military exercises

Cooperation on counterterrorism and counter-financing of terrorism within the Financial Action Task Force (FATF) framework

Space Collaboration

The two nations agreed to joint initiatives on space infrastructure development and commercialization, though specific details remain under development.

The Broader Strategic Context: Why This Matters for India's Foreign Policy

Regional Alignment in West Asia

The India-UAE partnership occurs amid significant geopolitical flux in West Asia. The bilateral agreement reflects shared strategic interests:

Middle East Stability: Both nations emphasize "regional peace, security and stability" and have expressed "full respect for each other's sovereignty and territorial integrity."

Support for India's BRICS Presidency: The UAE explicitly conveyed support for India's 2026 BRICS Chairmanship, underlining multilateral cooperation.

Water Security: India conveyed support for the 2026 UN Water Conference, to be co-hosted by the UAE, addressing the critical SDG 6 (water and sanitation).

Counter to Isolation Narratives

The visit reinforces that India maintains robust, diversified partnerships across the Global South despite Western criticism of India's pluralistic foreign policy approach. The UAE, itself a strategic partner of Western nations, demonstrates that nations can maintain multi-aligned relationships without forcing binary choices.

Investment & Wealth Fund Engagement

PM Modi extended a strategic invitation to UAE sovereign wealth funds to participate in India's second National Investment and Infrastructure Fund (NIIF), scheduled for launch in 2026. This reflects India's confidence in its investment climate and the UAE's capital abundance—a mutually beneficial arrangement.

Cultural Soft Power: House of India in Abu Dhabi

Beyond commercial and strategic dimensions, both nations agreed to establish a "House of India" in Abu Dhabi—a cultural museum showcasing Indian art, heritage, and archaeology.

This initiative reflects the 3.89-million-strong Indian diaspora in the UAE, the largest expatriate community in the Emirates. The cultural space will serve as both a bridge between peoples and a tangible symbol of India's civilizational contribution to global heritage.

Why This Matters for Your Exam Preparation

Key Concepts for UPSC Aspirants

1. Comprehensive Strategic Partnership Model

The India-UAE relationship exemplifies how modern bilateral partnerships extend across multiple dimensions—trade, energy, technology, defence, space, and culture—rather than focusing on a single issue. This "360-degree" engagement approach is becoming a template for India's partnerships with other strategic partners (Japan, Australia, Vietnam).

2. Energy Security as Foreign Policy

LNG procurement reflects a sophisticated understanding of energy security—not as military control of resources, but as diversified, long-term contracts with trusted partners. The 10-year HPCL-ADNOC deal demonstrates how energy agreements stabilize geopolitical relationships.

3. Data Sovereignty in the Digital Age

Digital Embassies represent an emerging frontier in international cooperation. For UPSC preparation, understand how nations balance technological interdependence with strategic autonomy—a key tension in contemporary geopolitics.

4. Technology Transfer via Strategic Partnerships

The supercomputing cluster and nuclear cooperation agreements show how India strategically leverages partnerships to access cutting-edge technology while building indigenous capabilities. This approach complements India's "Atmanirbhar Bharat" (Self-Reliant India) vision.

5. MSME-Driven Growth Strategy

Rather than relying solely on large corporations, India's trade expansion emphasizes grassroots entrepreneurship. Bharat Mart and the Virtual Trade Corridor exemplify how infrastructure can democratize access to global markets.

6. West Asia as Strategic Theater

India's West Asia policy balances multiple interests: energy security (oil/gas), investment and employment for diaspora, counterterrorism cooperation, and alignment with regional stability. The UAE visit underscores India's commitment to this region.

7. Regulatory Evolution (SHANTI Act)

The SHANTI Act signals India's willingness to modernize outdated legal frameworks to unlock economic potential. Similar liberalization may occur in other sectors—important context for understanding India's economic trajectory.

Potential UPSC Questions Based on This News

With reference to the India-UAE bilateral meeting of January 2026, discuss the significance of "Digital Embassies" for national data security. What are the regulatory challenges India and UAE must address? (GS Paper 3 - Science & Technology; GS Paper 2 - International Relations)

Analyze the role of the SHANTI Act (2025) in enabling India's nuclear energy expansion. How does private sector participation reshape India's clean energy strategy? (GS Paper 3 - Energy Security & Climate Change)

The India-UAE trade target of $200 billion by 2032 relies heavily on MSME empowerment. Evaluate the effectiveness of initiatives like Bharat Mart in addressing structural barriers faced by Indian small businesses in accessing global markets. (GS Paper 3 - Economic Development)

Discuss India's energy security strategy with specific reference to LNG procurement agreements and the target to increase natural gas share to 15% of the primary energy mix by 2030. (GS Paper 3 - Resources & Development)

How does India's strategic partnership with UAE contribute to India's broader West Asia policy objectives? What are the geopolitical implications? (GS Paper 2 - International Relations)

Key Statistics to Memorize for Exams

| Metric | Value | Source |

|---|---|---|

| Current India-UAE bilateral trade | $100 billion (FY 2024-25) | |

| Trade target by 2032 | $200 billion | |

| Current natural gas share in India's energy mix | 6–7% | |

| Target natural gas share by 2030 | 15% | |

| LNG supply under HPCL-ADNOC deal | 0.5 MMTPA | |

| Deal duration | 10 years (starting 2028) | |

| CEPA entry into force | May 1, 2022 | |

| Indian expatriates in UAE | 3.89 million | |

| Supercomputing capacity (G42 investment) | 2 GW data centre, 8 exaFLOP performance | |

| India's target nuclear capacity by 2047 | 100 GWe | |

| UAE visits by Sheikh Mohamed (past decade) | 5 visits (3rd as President) | |

Thematic Connections Across Other Current Affairs

India's BRICS Presidency (2026): This UAE visit reinforces India's non-aligned positioning and multilateral engagement.

Renewable Energy Integration: Natural gas acts as a transitional fuel alongside renewables in India's energy transition.

Make in India & Atmanirbhar Bharat: MSME export initiatives align with these flagship programs.

India-Middle East Economic Corridor (I2U2): Complements the broader India-UAE strategic engagement.

Geopolitical Alignment in West Asia: Context for understanding Indo-Iran relations, India-Israel cooperation, and Saudi engagement.

Conclusion: A Partnership for the Next Decade

The January 2026 India-UAE bilateral meeting represents far more than ceremonial diplomacy. Across twelve outcomes spanning trade, energy, technology, defence, space, and culture, the two nations have charted an ambitious course for the next six years. The $200 billion trade target, while ambitious, rests on proven success (CEPA has already doubled trade velocity) and structural investment in MSME connectivity.

More significantly, the partnership explores frontier areas—Digital Embassies, supercomputing infrastructure, advanced nuclear technology—that will define India's strategic position in a rapidly evolving technological and geopolitical landscape. For UPSC aspirants, this meeting encapsulates the multifaceted nature of contemporary international relations: energy security, technology transfer, data governance, climate action, and soft power all converge in bilateral partnerships.

As India assumes the BRICS Chair and navigates competing claims for influence in West Asia, the UAE relationship serves as a template for partnerships combining strategic alignment with economic interdependence, creating resilience against external pressures.