IMF: How the International Monetary Fund Manages the World Economy | Atharva Examwise Current News

IMF in Current Affairs (16 May 2025): $1 Billion Aid to Pakistan

Recently, during the tensions between India and Pakistan, the International Monetary Fund (IMF) announced a $1 billion (about ₹8,300 crore) loan to Pakistan. This amount was given to address climate-related challenges and maintain economic stability, bringing the IMF’s global role into the spotlight once again.

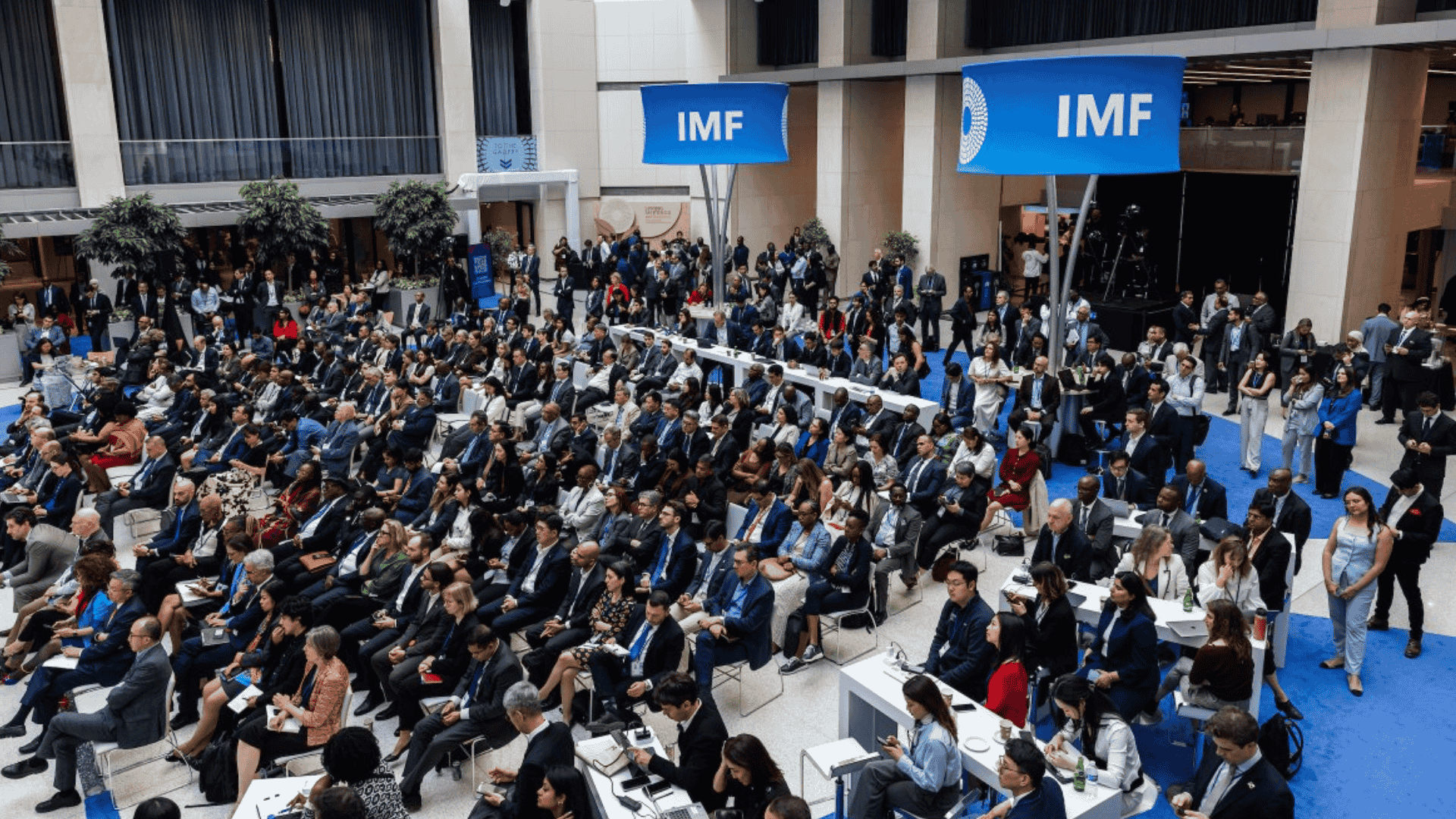

What is the IMF? – Introduction

The IMF (International Monetary Fund) is an international organization established in 1944 at the Bretton Woods Conference. Its objectives are global economic stability, monetary cooperation, promoting international trade, and reducing poverty. Today, the IMF has 191 member countries, and its headquarters is in Washington, D.C.

Main Functions of the IMF

1. Lending During Economic Crisis

The IMF provides loans to member countries during economic crises, helping them resolve balance of payments issues.

2. Economic Surveillance and Advice

The IMF monitors the economic policies of member countries and offers advice for improvement to ensure global economic stability.

3. Technical Assistance and Capacity Building

The IMF also provides technical assistance and training to governments in areas such as taxation, budget management, and monetary policy.

Organizational Structure of the IMF

Board of Governors: The highest decision-making body, comprising finance ministers or central bank governors of member countries.

Executive Board: A 24-member board responsible for day-to-day decisions.

Managing Director: The head of the IMF, who chairs the Executive Board.

How Does the IMF Lend Money? – Three Main Methods

1. New Arrangements to Borrow (NAB)

During global crises, the IMF borrows from wealthy countries (such as the USA, Japan, Germany) and lends to countries in need.

2. Bilateral Borrowing Agreements

If NAB does not provide sufficient funds, the IMF borrows directly from certain member countries, increasing its lending capacity.

3. Special Drawing Rights (SDR)

SDR is an international reserve asset created by the IMF, allowing member countries to strengthen their foreign exchange reserves.

Voting and Membership in the IMF

The IMF has 191 member countries.

Each country has one vote, but the value of the vote depends on its "quota." The quota is based on the country’s economic strength, GDP, and trade.

The USA has the largest quota (16.5%), giving it the most voting power. India’s quota is 2.75%.

Decisions in the IMF are made based on voting, but often by consensus.

Recent Developments: IMF, India, and Pakistan

Recently, the IMF provided $1 billion in assistance to Pakistan, which India objected to.

According to IMF rules, member countries cannot vote against a proposal; they can only support or abstain.

The USA and other major countries have significant influence in the IMF’s decisions.

Key Takeaways: Daily GK Update

The IMF was established in 1944 to ensure global economic stability.

The IMF provides loans, advice, and technical assistance to member countries during crises.

Voting power in the IMF depends on a country’s quota.

Recently, Pakistan received a $1 billion loan from the IMF to address climate challenges.

India’s quota in the IMF is 2.75%, while the USA’s is the largest at 16.5%.

Major countries have significant influence over IMF decisions.

Why this matters for exams

Questions related to the IMF are frequently asked in UPSC, banking, SSC, and other competitive exams. Understanding the IMF’s role, functioning, voting system, and recent developments (such as the loan to Pakistan) is crucial for your current affairs and daily GK update preparation. Stay connected with Atharva Examwise to remain updated with every important competitive exam news.

For more information and daily current affairs, visit: www.atharvaexamwise.com