Introduction

India's ambitious climate commitments have taken a significant step forward with the recent announcement of greenhouse gas emission intensity targets for eight major industrial sectors under the Carbon Credit Trading Scheme (CCTS). As the country prepares to launch its domestic carbon market by October 2026, a crucial question emerges: Are these targets ambitious enough to drive meaningful decarbonization?

Recent analysis by leading think tanks like the Council on Energy, Environment and Water (CEEW) suggests that while India's carbon trading framework represents a structural shift from energy efficiency to emissions reduction, the current targets may fall short of the ambition required to meet national climate goals. This development holds immense significance for UPSC and competitive exam aspirants as it intersects environment, economy, and governance themes.

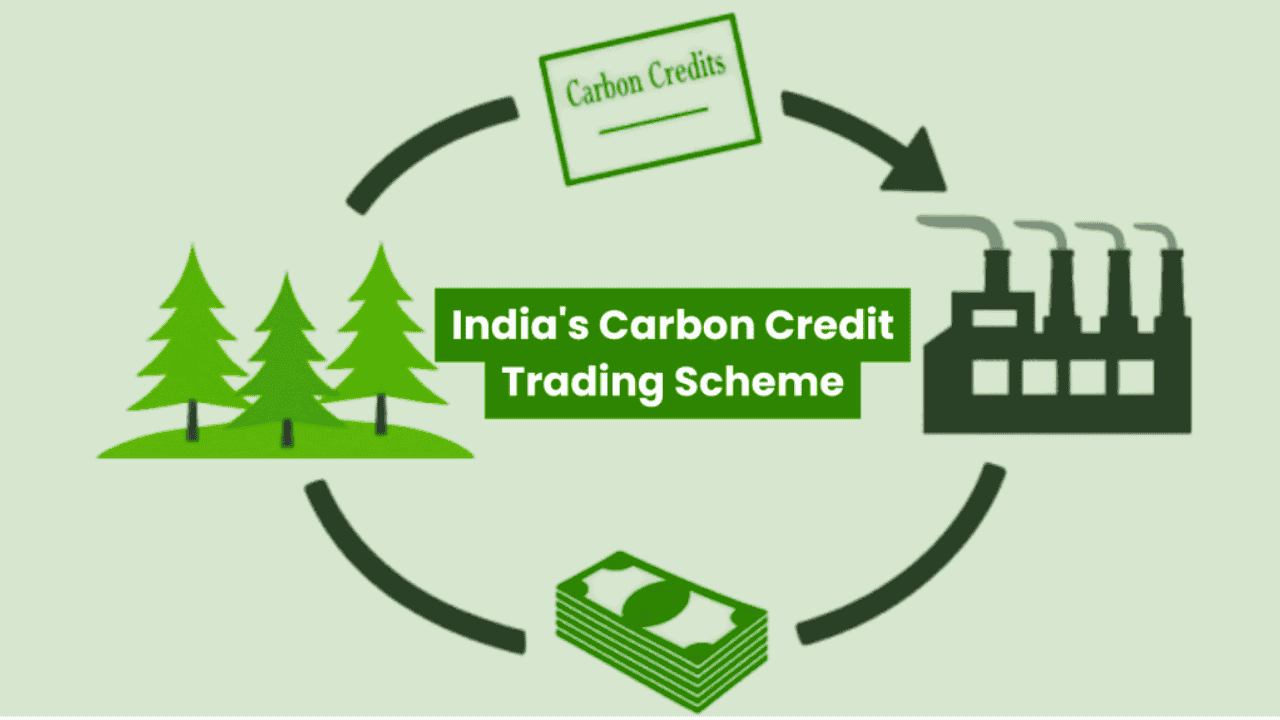

Understanding India's Carbon Credit Trading Scheme (CCTS)

Legal Framework and Structure

The Energy Conservation (Amendment) Act, 2022 provides the legal foundation for India's carbon market, marking a transition from the existing Perform, Achieve and Trade (PAT) scheme to a comprehensive emissions trading system. The CCTS operates through two primary mechanisms:

Compliance Mechanism:

Mandatory participation for 282 industrial entities across four sectors initially

Covers approximately 16% of India's total emissions

Baseline year: 2023-24

Target years: 2025-26 and 2026-27

Voluntary Offset Mechanism:

Open to non-obligated entities

Encourages voluntary emission reduction projects

Supports achievement of Nationally Determined Contributions (NDCs)

Key Institutional Players

| Institution | Role | Responsibility |

|---|---|---|

| Bureau of Energy Efficiency (BEE) | Administrator | Target calculation, certificate issuance, market operation |

| Ministry of Environment, Forest and Climate Change | Policy Maker | Target setting, regulatory oversight |

| Central Electricity Regulatory Commission (CERC) | Regulator | Market regulation, trading oversight |

| Central Pollution Control Board (CPCB) | Enforcement | Penalty imposition, compliance monitoring |

Sectoral Coverage and Emission Targets

Phase 1 Implementation (2025-27)

The initial phase covers 282 entities across four key sectors:

Aluminium Sector:

13 entities including major players like Vedanta and Hindalco

Target: 5.85% emission intensity reduction over two years

Baseline: 2023-24 production levels

Cement Sector:

186 entities (largest coverage)

Contributes 5.8% of India's carbon emissions

Target: 3.4% reduction for OPC and PPC units

Considered the least ambitious among covered sectors

Chlor-alkali Sector:

30 entities

Target: 7.54% emission intensity reduction

Most stringent targets among the four sectors

Pulp and Paper Sector:

53 entities

Target: 7.15% reduction

Significant improvement over historical PAT performance

Future Expansion

The scheme will eventually encompass nine sectors, with plans to include:

Iron and Steel

Petrochemicals

Petroleum refineries

Fertilizers

Textiles

Notable Exclusion: The power sector, responsible for 39.2% of India's carbon emissions, remains outside the current framework.

Assessing Ambition: The Economy-wide Perspective

CEEW Analysis Findings

Recent research by the Council on Energy, Environment and Water (CEEW) provides crucial insights into the ambition level of India's carbon market targets:

Key Findings:

Combined average annual Emission Intensity of Value Added (EIVA) reduction: 1.68% (2023-24 to 2026-27)

Manufacturing sector requirement: 2.53% annual reduction to align with NDC

Energy sector target: 3.44% annual reduction needed

Conclusion: Industrial targets may not be ambitious enough

Historical Context: PAT Scheme Performance

The Perform, Achieve and Trade (PAT) scheme provides valuable lessons for assessing carbon market ambition:

PAT Cycle I (2012-2015) Achievements:

Energy savings: 8.67 MTOE (30% above target)

CO2 emission reduction: 31 million tonnes

Trading volume: 13 lakh ESCerts worth INR 100 crores

Sector performance: Mixed results with energy intensity rising in some sectors but declining overall

Key Insight: Even when individual entities or sectors showed increased energy intensity, the aggregate effect demonstrated successful market-based emission reduction.

Why Economy-wide Assessment Matters

Market Mechanism Effectiveness

The analysis reveals a fundamental principle: externality-driven markets should be evaluated at the aggregate level rather than individual entity performance. This approach recognizes that:

Market mechanisms enable cost-effective emission reductions

Entities with high marginal abatement costs can purchase credits

Overall emission reduction remains the primary objective

Financial transfers between entities don't determine aggregate success

Comparison with NDC Trajectory

For meaningful ambition assessment, targets must align with:

India's 2030 NDC commitment: 45% emission intensity reduction

2070 net-zero pathway requirements

International best practices in carbon pricing

Regulatory Framework and Compliance

Penalty Mechanism

The CCTS incorporates robust enforcement through:

Environmental compensation equal to twice the average carbon credit price

Penalties imposed by Central Pollution Control Board (CPCB)

Funds directed toward carbon trading scheme objectives

Monitoring, Reporting, and Verification (MRV)

The scheme establishes comprehensive MRV frameworks including:

Annual verification of GHG emissions data

Accredited carbon verification agencies

Transparent reporting mechanisms

Registry-based tracking systems

International Context and Implications

EU Carbon Border Adjustment Mechanism (CBAM)

Starting 2026, the EU's CBAM will impose tariffs on carbon-intensive imports, making India's carbon market crucial for:

Export competitiveness in steel and cement sectors

International credibility of emission reduction claims

Trade barrier mitigation for Indian manufacturers

Paris Agreement Alignment

The CCTS supports India's commitments under:

Article 6 of the Paris Agreement

Nationally Determined Contributions (NDCs)

Global climate action coordination

Current Affairs Relevance for UPSC

Recent Developments (2024-2025)

July 2024: Government adopted detailed CCTS regulations

April 2025: MoEFCC issued draft emission intensity targets

May 2025: CEEW published ambition assessment analysis

June 2025: BEE released target-setting methodology

July 2025: Stakeholder consultations ongoing

Policy Implications

The carbon market development intersects with several UPSC-relevant themes:

Environmental governance and institutional coordination

Economic policy and market-based mechanisms

International relations and climate diplomacy

Sustainable development and industrial transformation

Challenges and Opportunities

Implementation Challenges

Sectoral Coordination:

Multiple ministries and agencies involved

Transition from PAT to CCTS requires careful management

Capacity building for industry participants

Market Development:

Ensuring adequate liquidity and price discovery

Preventing market manipulation

Building investor confidence

Opportunities for Enhancement

Sectoral Expansion:

Including power sector (39.2% of emissions)

Covering transportation and buildings

Integrating with state-level initiatives

International Linkages:

Connecting with global carbon markets

Exploring Article 6 mechanisms

Enhancing export competitiveness

Frequently Asked Questions (FAQs)

Q1: How does CCTS differ from the PAT scheme?

A: CCTS focuses on greenhouse gas emission intensity rather than energy efficiency, uses Carbon Credit Certificates (CCCs) instead of ESCerts, and covers emission reduction across all greenhouse gases.

Q2: Which sectors are currently excluded from CCTS?

A: The power sector (39.2% of emissions) and several industrial sectors are currently excluded, though expansion is planned.

Q3: How are emission targets calculated?

A: Targets are set using a benchmarking approach with 2023-24 as baseline, considering entity-specific emission intensities and sector-wide performance.

Q4: What happens if companies don't meet targets?

A: They must purchase carbon credits or pay environmental compensation equal to twice the average carbon credit price.

Q5: When will carbon trading begin?

A: Full compliance trading is expected to begin by October 2026.

Why this matters for your exam preparation

For UPSC Civil Services

General Studies Paper 3 Topics:

Environment and Climate Change: Carbon markets, emission trading, NDCs

Economic Development: Market-based mechanisms, industrial policy

Government Policies: Regulatory frameworks, institutional coordination

Science and Technology: Emission monitoring, verification technologies

Current Affairs Integration:

Latest policy announcements and target revisions

International climate negotiations and CBAM implications

Sectoral performance analysis and ambition assessment

Institutional developments and regulatory changes

For State PCS and Other Competitive Exams

Key Preparation Areas:

Understanding carbon market mechanisms and operations

Comparing PAT scheme with CCTS framework

Analyzing sectoral emission patterns and reduction strategies

Evaluating policy effectiveness and implementation challenges

Essay and Mains Writing:

Climate change mitigation strategies

Market-based environmental policies

India's transition to low-carbon economy

International cooperation on climate action

Practical Tips:

Study recent CEEW and think tank reports on carbon markets

Follow MoEFCC notifications and BEE regulations

Understand linkages between carbon pricing and export competitiveness

Practice questions on institutional roles and regulatory mechanisms

The development of India's carbon market represents a paradigm shift in climate policy, moving from voluntary commitments to market-driven obligations. While current targets may require enhancement to meet long-term climate goals, the framework establishes crucial infrastructure for economy-wide decarbonization. For competitive exam aspirants, understanding these mechanisms is essential for comprehending India's approach to sustainable development and climate leadership in the 21st century.

The ongoing assessment of target ambition highlights the importance of evidence-based policy making and the need for continuous calibration of climate instruments. As India prepares for its 2035 NDC submission, the lessons learned from CCTS implementation will be crucial for enhancing climate ambition while maintaining economic competitiveness.